The business of extracting and transporting oil and gas is filled with challenges. To stay competitive, companies in this industry must continually strive to produce crude oil and refined products at a lower cost. They are also constantly looking to enhance and extend the value of their existing assets while also searching for new oil and gas reserves. And environmental standards are becoming increasingly stringent, requiring transparency in operations and tighter controls on production and distribution.

To overcome these challenges, oil and gas companies worldwide are thinking creatively once again. Keep in mind that challenges like these aren’t necessarily new to the oil and gas industry. For the past few decades, there’s been a huge incentive to improve efficiencies and reduce downtime, which has led to the implementation of things like predictive analytics and machine learning. (Some would classify these as being part of the Internet of Things, or IoT, but my definition of “IoT” is a narrower one, referring specifically to connected sensors and controllers and everything upstream of that—things that create data or can take action based on command.)

Now, analytics data is becoming easier to acquire thanks to the IoT. Connectivity technology is improving, sensors are cheaper, low power technology is available, and batteries can last longer. All those developments mean oil and gas companies can use more sensors in more places to monitor machinery and environmental conditions—especially at that “last mile,” where affordable connectivity was previously not an option.

Now, analytics data is becoming easier to acquire thanks to the IoT. Connectivity technology is improving, sensors are cheaper, low power technology is available, and batteries can last longer. All those developments mean oil and gas companies can use more sensors in more places to monitor machinery and environmental conditions—especially at that “last mile,” where affordable connectivity was previously not an option.

Within this article, we’ll first explore how the traditional methods oil and gas companies use for monitoring are changing. We’ll then look at several use cases where low power, wide-area networks (LPWAN) can offer a unique hybrid solution for M2M applications in the oil and gas industry.

Smart Oil & Gas Monitoring Methods

Oil and gas companies typically have numerous remote assets that require monitoring. Traditionally, they’ve utilized the following monitoring methods:

- Programmable logic controller (PLC) systems. These are essentially wired IoT communications, and they are used frequently in the industrial field. The challenge with collecting data using wires is that someone has to run those wires, and that process can become quite expensive. Additionally, the architecture of these wired systems is more complex—so once you build a PLC system, you’re stuck with it. Frequently, these systems use serial communication standards (like RS-232 and RS-435).

- Satellite communications (such as Iridium and Inmarsat). The drawback here is that satellite connectivity can be expensive. However, since the oil and gas industries traditionally had a big incentive for remote monitoring, the costs were often justified.

- Physical monitoring. Employing individuals to physically walk around and monitor levels and measurements by hand is something many oil and gas companies still do. The benefit to this method is it is relatively straightforward and easy to implement, and there is a history of training to go along with this method. On the other hand, the time and labor costs associated with this type of monitoring can be high, especially in remote locations (like where many oil and gas wells are located).

Each of these solutions has benefits and considerations to take into account. The main considerations are:

- Price: The cost of setting up a wired system is typically quite high.

- Complexity: Satellite monitoring, for example, often requires numerous communication links to deliver information.

- Time: Physical monitoring of oil and gas fields takes substantial effort and manpower.

As the machine-to-machine (M2M) market has grown and expanded over the past several years, some oil and gas companies are looking to take what used to be wired and make it wireless, so they can further consolidate their connections. Wireless IoT solutions allow these companies to do things in a more ad hoc way. For instance, they’re able to add 100 sensors in a single well, and then add another 1,000 sensors when they deem necessary. This is far easier with wireless technologies than it is for PLC and other wired systems. Note: Because the process of monitoring wells is highly complex with a lot of moving parts (and a lot of value), it may not always make sense to use wireless technology—even if it’s available. This can only be determined on a case-by-case basis.

How IoT Technology Is Shaping The Oil & Gas Industries

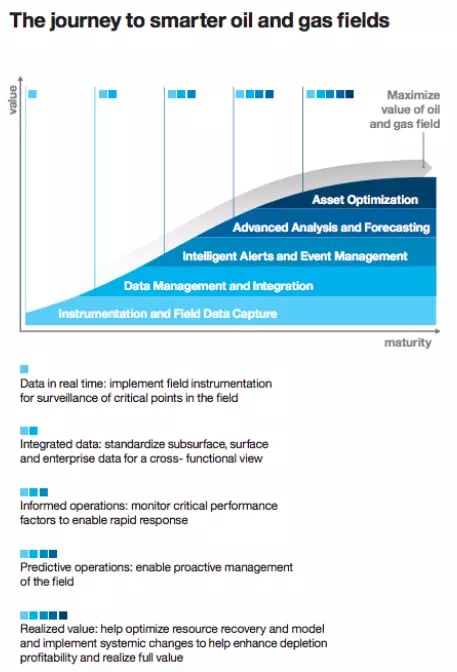

The oil and gas industry is still evolving when it comes to realizing the full value of the IoT; it hasn’t yet revolutionized oil and gas like it has other industries. However, the IoT is making it a lot easier for companies to collect vital information, which has led to more informed business decisions. Connected wireless technology is helping the oil and gas industries:

- Optimize for efficient pumping activities.

- Maintain the pipes and wells.

- Monitor equipment failures and gas leaks.

- Monitor pipe thickness, temperatures, and erosion in a refinery.

Wireless IoT allows companies to monitor more things using sensor-level technology, take fewer readings by hand, and gather more data and information in order to better optimize business processes. I can’t speak to what’s going on behind the scenes with big data, but I can speak to the fact that sensor-driven IoT can make the process of gathering this data substantially easier.

For instance, it’s important for even a small oil company to have solid well optimization to increase its profitability. If the company is drilling a new well, it has to inject chemicals into the well to keep rocks from building up, which provides viscosity to pull the rocks up as the company is drilling. Once the well is online and producing, the company has to do a balance of pressure, make sure the temperatures are correct, ensure it is extracting the right quantities of oil, and so on. When there are more data points about the microscopic conditions in a well (ranging from temperatures, pressures, rates, chemical compositions, viscosity, etc.), the company is able to collect the necessary data, run post-production analysis, optimize current and future drilling processes, and hopefully increase its market share and profitability.

This is reminiscent of industrial control systems and their progression toward wireless. Like oil and gas, industrial automation has been around for a very long time. These companies began using original wired IoT technologies to drive costs down and connect parts of their controlled networks. But as wireless sensor automation became more prevalent in the market—and thus, more accessible—these companies could use wireless sensors to connect more easily, capture more data, analyze that information, and improve their processes.

Let’s take a look at some of the ways oil and gas companies are using the IoT to gather that actionable data, thereby improving operations.

Internet of Things: 5 Oil & Gas Use Cases

The IoT use cases that are currently generating the most value for the oil and gas industry center around lowering non-productive time (NPT). NPT—which can be caused by anything from inclement weather to equipment failures—has a major impact on revenue, accounting for about 10 to 20 percent of total drilling costs. The IoT is helping companies combat NPT by allowing them to perform better predictive maintenance, more accurately predict failures, and detect leaks quickly—essentially, to find problems before they start.

But building an IoT oil and gas network for an area that is sparsely populated or isolated can be quite challenging. There’s often not the necessary consistency in node placement for a mesh network, cellular coverage is often unavailable, and satellite and wired connections are very costly. In many cases, low power wide area (LPWAN) networks offer a good alternative for M2M communication in oil and gas.

Offshore Oil & Gas Rig Monitoring

Most offshore oil and gas production is done in fairly extreme environments where there are few existing communication networks available, which makes monitoring temperatures, pressures, flow rates, and other characteristics tricky and expensive. Often, cellular networks aren’t an option. And while you could use a WiFi network or a mesh network, you’d likely have to over-engineer it for it to be functional. To deal with these realities, critical data is typically extracted through the use of satellite communications or wired networks, both of which come at a steep cost.

Using LPWANs, you can connect a lot more monitoring points relatively inexpensively. For instance, you could connect xx leak detectors on xx wells located within a xx-square mile area on an LPWAN network. Each of those detectors then sends information back to a central point, which is connected to a satellite. (Or, the data could simply be processed on-site, depending on the company’s wants and needs.) A hybrid solution like this one allows you to collect much more data than the traditional monitoring method. LPWANs can also be helpful in measuring salinity (to ensure there are no water-to-fuel leaks) and monitoring equipment and personnel on-site.

Refinery Monitoring

In an oil and gas refinery, the Internet of Things could be used to monitor things like pipe thickness, flow rate, pipe pressure, and more. If these areas are accessible to human personnel, a lot of measurements are typically logged by hand. But logging this amount of information by hand is a time-consuming job, and fairly costly for the company.

Keep in mind that some areas of a refinery need to be measured in exact real-time—for instance, a valve that needs to be controlled based on a flow rate being monitored elsewhere. In that case, a change in flow rate would require almost instantaneous control of the valve. With most radio systems, it’s hard to guarantee data is being sent in real-time with 100% accuracy—LPWAN systems aren’t typically designed for extremely high throughputs. So if readings need to be taken every fraction of a second, the refinery will likely rely on a wired system.

But what the Internet of Things (IoT) does allow for is hitting more points for more accurate data. For example, many aspects of a refinery are engineered with specific levels of uncertainty because they simply can’t be measured. For example, a particular part of the refinery may not be able to run at the same pressure as it would if more reading points were available. To solve that problem, the IoT could provide greater insight and extra data about the flow, allowing the refinery to run at higher capacity. The IoT network would also save the refinery money by limiting the personnel needed to manually monitor, or the amount of equipment that requires wired communications.

Pipeline Monitoring

One of the primary concerns with oil and gas pipelines is leakage, and the financial, environmental, and reputational damage it could cause. If methane gas is released without being burned, it has, pound for pound, about 25 times the impact on climate change than carbon dioxide has over a 100 year period. There’s also a high explosion risk for a gas leak when it’s exposed to atmospheric pressure. And while oil doesn’t hold a risk of explosion, there are major risks associated with pipeline leaks. Companies could lose their assets, and their pollution could potentially lead to astronomical fines.

Prior to the IoT, satellite internet monitored key points in the pipeline and extrapolated data to measure total system performance. With the integration of machine-to-machine (M2M) oil and gas solutions, more key points can be monitored for less money.

The IoT can also help monitor pipeline components, like pumps and filters. Without a “smart” system, a company would have to send someone to perform periodic, routine maintenance every three months, for example. But with the extra data the company could gather from its IoT system, it may be able to wait for maintenance and pump and filter replacement until the performance of the system starts to decline (though some amount of preventative maintenance will prudently still be performed).

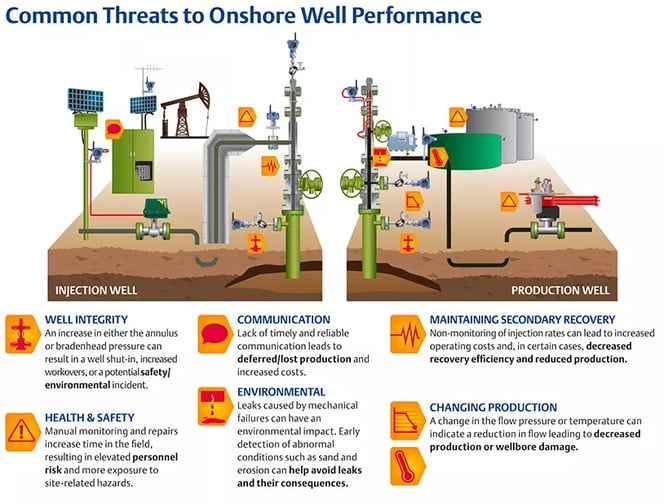

Wellhead Monitoring

Today, there are several companies—like Ambyint (previously PumpWell) and WellAware—that provide IoT solutions for wellhead and pumpjack monitoring and other gas and oil monitoring needs. According to WellAware, its production management solutions help companies reduce lease operating expenses, minimize unplanned downtime, and ensure safety and regulatory compliance. Data companies collect feeds into a platform that may tell the company, for example, if they should be injecting more chemicals or steam into the well, or what kind of vacuum pressures are optimal given the conditions.

There’s a lot that goes into the oil and gas extraction process, and IoT devices make monitoring and gathering data on these things easier. The visual below, created by Emerson Process Management, describes some of the common threats to well performance.

Oil & Gas Cargo Shipping

Oil and gas cargo ship monitoring is similar to the offshore use case in that there’s typically no connectivity in the middle of the ocean other than satellite internet. If you want to collect data from around your ship, which can be very big itself, your options are limited.

LPWANs allow you to remotely monitor parts of the ship that personnel don’t regularly go to (or are nearly impossible to access). This adds a layer of both safety and convenience. While some elements of oil and gas cargo ships have to be wired due to real-time needs of the propulsion plant, some non-operational elements—temperatures, pressures, flows, etc.—don’t need to be backhauled using satellite, or connected in real time. Therefore, small IoT networks can be great alternatives to wired sensors and gages.

Supply-chain Management

The dynamic nature of the oil and gas industry can make inventory planning and optimization difficult. The IoT can help with procurement planning and scheduling. For example, refineries could use sensors to detect which types of crude oil or crude oil blends are incoming and/or where each type is stored. Having this data available would be valuable for production and operation decisions. It could also be used to measure crude composition for inventory purposes.

Constant Evolution

Smart oil and gas have been, and will continue to be, long-evolving processes. The Internet of Things didn’t dramatically change these fields, but wireless technology does put gas and oil companies at a unique advantage. In fact, I believe they are well-positioned to make some of their biggest strides now that connecting “things” is cheaper and the technology is more sophisticated than ever. If companies can collect information (and thus, run further data analysis) with a limited number of endpoints, imagine how much could be done with more granular information.

Connectivity isn’t an issue for everyone in the oil and gas industry. If you have access to cellular networks, and what you’re monitoring is high-value enough to merit the price tag, you may not need LPWAN technology. But if you’re looking to improve operational efficiencies and cut costs in a number of ways, this information may help you take on incumbents in the market.

If you’re dealing with connectivity problems in your oil and gas application, contact us to see how we can help.